Triethylene glycol (TEG) is a versatile chemical compound widely used across various industries, including natural gas processing, industrial dehydration, and chemical manufacturing. Known for its hygroscopic properties, TEG is primarily used as a dehydrating agent to remove water vapor from natural gas pipelines. Additionally, TEG is used in the production of polymers, as a plasticizer in rubber and plastic industries, as well as in the formulation of cosmetics, paints, and antifreeze solutions. Its demand, and consequently its price, is influenced by a combination of factors such as demand from the energy sector, feedstock prices, production costs, and regulatory policies.

Understanding the Triethylene Glycol Price Analysis is essential for businesses that rely on it for their operations. Fluctuations in TEG prices can impact costs in sectors like natural gas processing, where TEG is a critical component for dehydration. By analyzing the factors driving these price changes, companies can make informed purchasing and production decisions.

Current Market Demand and Supply Factors

1. Demand for TEG in Key Industries

The demand for TEG is closely tied to the health of several key industries:

Natural Gas Processing: TEG is a major dehydrating agent used to remove water vapor from natural gas, making it essential for this industry. With the rise in global energy demand, particularly for cleaner alternatives like natural gas, the demand for TEG has increased in recent years. Consequently, fluctuations in the natural gas market can directly influence TEG prices.

Polymer and Plastics Manufacturing: TEG is used as an intermediate in the production of certain polymers and as a plasticizer. Demand from the polymer and plastics industry can impact TEG pricing, especially when consumer demand for plastic-based products fluctuates.

Cosmetics and Antifreeze Production: TEG is used in a variety of consumer products, including cosmetics, antifreeze, and de-icing solutions. While the demand from these sectors is relatively stable, seasonal variations (such as the increased need for de-icing in colder months) can cause temporary price fluctuations.

2. Supply and Production Capacity

The supply of TEG depends on the availability and production of ethylene oxide (EO), which is a primary feedstock for TEG. Ethylene oxide is produced through the oxidation of ethylene, and thus, any disruptions in ethylene or ethylene oxide production can affect TEG supply.

Additionally, TEG production is concentrated in a few regions, with significant production facilities located in North America, Europe, and Asia. Geopolitical tensions, trade restrictions, and regional demand can influence the supply chain, thereby impacting TEG prices.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/triethylene-glycol-price-trends/pricerequest

Historical Price Trends

1. Price Trends Over the Past Decade

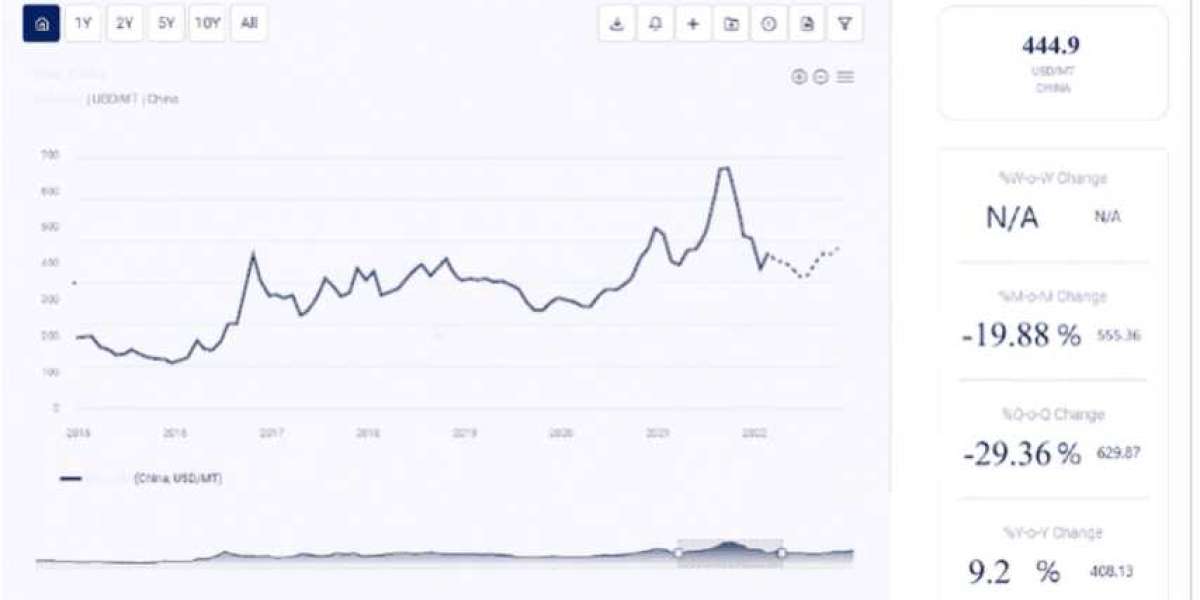

Over the past decade, TEG prices have experienced notable fluctuations, largely due to changes in the energy market, feedstock prices, and industrial demand. For instance, from 2010 to 2015, TEG prices were relatively stable, supported by steady demand from natural gas processing and consumer goods industries. However, between 2016 and 2019, TEG prices saw a moderate increase, driven by rising demand for natural gas, particularly in Asia, and increased usage of TEG in de-icing solutions in colder regions.

The COVID-19 pandemic in 2020 disrupted this trend, with prices initially dropping due to reduced industrial activity and transportation. However, prices quickly rebounded in 2021 as global economies recovered, supply chain bottlenecks emerged, and demand for natural gas surged. These factors contributed to price volatility, with TEG prices reaching new highs in 2021.

2. Economic Events Influencing TEG Prices

Global economic events and shifts in oil and gas markets have a significant influence on TEG prices. For example, the 2008 financial crisis led to a temporary decline in demand for industrial chemicals, causing TEG prices to drop. Similarly, the 2020 COVID-19 pandemic initially reduced demand but was followed by a rapid recovery, resulting in supply chain disruptions and rising prices.

Additionally, geopolitical events, such as the U.S.-China trade tensions and OPEC's decisions on oil production, have indirectly influenced TEG prices by impacting the cost and availability of raw materials like ethylene.

Key Factors Influencing Triethylene Glycol Prices

Several factors play a role in determining the price of TEG, and understanding these drivers is essential for businesses that rely on this compound.

1. Feedstock Costs and Availability

The production of TEG depends on ethylene oxide, which is derived from ethylene, a byproduct of crude oil and natural gas processing. As a result, TEG prices are heavily influenced by fluctuations in the prices of crude oil and natural gas:

Crude Oil Prices: Rising crude oil prices can increase the cost of ethylene, subsequently driving up the cost of TEG production. Conversely, lower oil prices can lead to more affordable TEG.

Natural Gas Prices: Ethylene can also be derived from natural gas feedstocks, meaning that high natural gas prices can increase the production cost of TEG. With natural gas becoming a preferred energy source, its prices can significantly affect TEG costs.

2. Global Demand for Natural Gas

As TEG is primarily used in natural gas dehydration, the demand for natural gas directly impacts TEG prices. Countries transitioning to cleaner energy sources have increased their reliance on natural gas, boosting demand for TEG. This trend is particularly pronounced in Asia, where developing economies are moving toward natural gas to reduce carbon emissions.

- Energy Sector Growth: Rising energy demand in developing nations, combined with global initiatives for cleaner energy, has increased the demand for natural gas, which indirectly pushes up TEG prices.

3. Seasonality and Weather Conditions

Seasonal demand changes, particularly for de-icing and antifreeze solutions, can impact TEG prices. During colder months, demand for TEG rises as it is used in de-icing products. Similarly, harsh winters or extreme weather events can increase the need for de-icing chemicals, leading to temporary price spikes.

In addition, natural gas demand often increases during colder months for heating purposes, further driving up the need for TEG in natural gas processing and consequently impacting prices.

4. Environmental Regulations and Compliance Costs

The production and use of chemicals, including TEG, are subject to various environmental regulations. Stricter emissions standards and regulatory policies aimed at reducing the environmental impact of industrial chemicals can affect TEG production costs:

Emission Standards: TEG production involves the release of emissions that need to be managed to comply with environmental regulations. Stricter standards can increase production costs, which may be passed on to consumers.

Sustainable Practices: Some companies are adopting greener practices in response to regulatory pressure and consumer demand. Although this can initially increase costs, companies may benefit from long-term sustainability and improved brand image.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA