Global Banking Cyber Security Market Share Set to Surpass USD 554.35 Billion by 2030

Driven by Digital Transformation and Escalating Cyber Threats

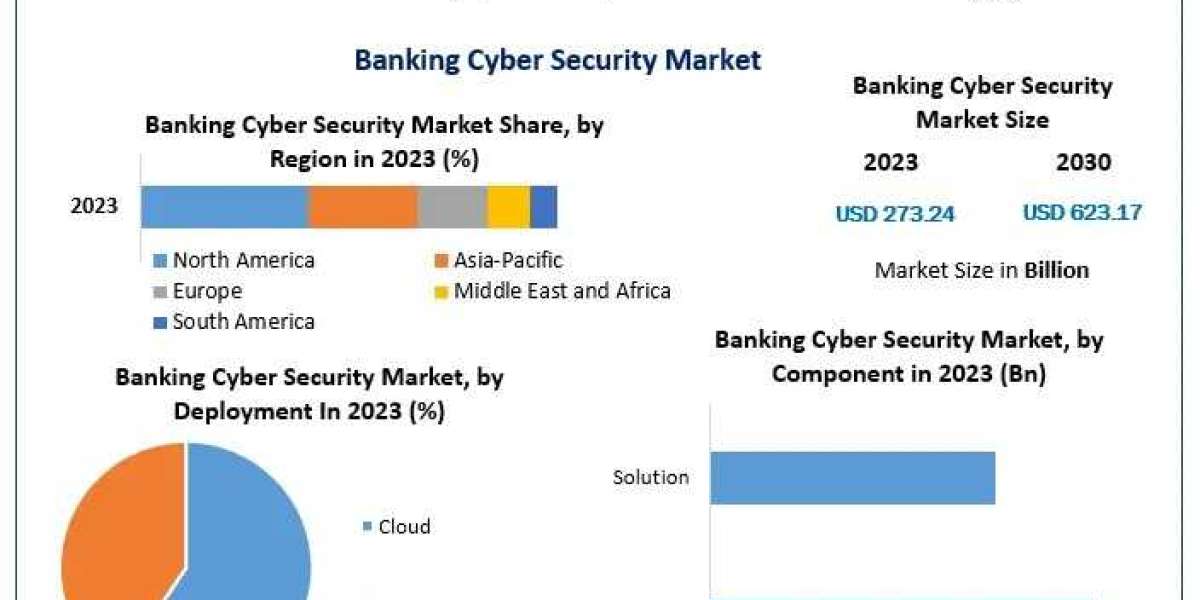

[City, Date] – The global banking cyber security market, valued at USD 273.24 billion in 2023, is projected to reach USD 554.35 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period.

Secure your sample copy of this report immediately: https://www.maximizemarketresearch.com/request-sample/92354/

Market Definition and Scope

Banking cyber security encompasses a suite of technologies, processes, and practices designed to protect banking institutions' digital assets—including networks, devices, programs, and data—from unauthorized access, damage, or theft. As the banking sector undergoes rapid digital transformation, safeguarding sensitive financial information has become paramount.

Key Growth Drivers and Opportunities

- Digital Transformation in Banking: The shift towards digitization has revolutionized banking services, offering enhanced efficiency and accessibility. However, this evolution has also expanded the attack surface for cybercriminals, necessitating robust security measures.

- Escalating Cyber Threats: The financial sector has witnessed a surge in cybercrimes, with a reported 60% increase in fraud in 2021. This alarming trend underscores the critical need for advanced cyber security solutions to protect against sophisticated attacks.

- Regulatory Compliance: Governments and regulatory bodies worldwide are enforcing stringent data protection laws, compelling banking institutions to adopt comprehensive cyber security frameworks to ensure compliance and avoid hefty penalties.

- Technological Advancements: The integration of Artificial Intelligence (AI), Machine Learning (ML), and blockchain technologies in cyber security solutions offers proactive threat detection and mitigation, presenting lucrative opportunities for market expansion.

Grab your free sample copy of this report today: https://www.maximizemarketresearch.com/request-sample/92354/

Segmentation Analysis

The banking cyber security market is segmented based on deployment, component, and region:

- By Deployment:

- Cloud: Offers scalability and cost-effectiveness, driving its adoption among banking institutions.

- On-Premises: Preferred by organizations seeking direct control over their security infrastructure.

- By Component:

- Solutions: Encompasses software tools designed to detect and prevent cyber threats.

- Services: Includes consulting, implementation, and maintenance services to support security solutions.

Regional Insights

- North America: Dominates the market due to early adoption of advanced technologies and a high incidence of cyber attacks, prompting substantial investments in cyber security.

- Europe: The enforcement of stringent regulations like the General Data Protection Regulation (GDPR) has propelled the adoption of robust cyber security measures across banking institutions.

- Asia Pacific: Rapid digitalization and increasing internet penetration have made this region a hotspot for cyber threats, driving the demand for comprehensive security solutions.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/92354/

Competitive Landscape

The market is characterized by the presence of key players focusing on innovation and strategic collaborations to enhance their offerings:

- IBM Corporation: Offers a comprehensive suite of cyber security solutions tailored for the banking sector, leveraging AI and cloud technologies.

- Cisco Systems, Inc.: Provides integrated security solutions that ensure end-to-end protection for banking networks and data.

- Palo Alto Networks: Specializes in advanced firewalls and cloud-based security services, catering to the evolving needs of banking institutions.

- Check Point Software Technologies: Delivers multi-layered security solutions, emphasizing threat prevention and data protection.

Curious about market analysis? The research report summary offers valuable insights: https://www.maximizemarketresearch.com/market-report/global-banking-cyber-security-market/92354/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656