Ruthenium is a rare transition metal belonging to the platinum group of metals (PGMs). It is characterized by its hardness, high melting point, and excellent corrosion resistance. Due to these properties, ruthenium has become increasingly important in various industrial applications, including electronics, chemical catalysis, and jewelry. Understanding the price trends of ruthenium is crucial for investors, manufacturers, and policymakers, as they reflect broader economic conditions and market dynamics.

This article provides a comprehensive analysis of ruthenium Latest Price, examining historical price movements, key factors influencing these trends, current market conditions, and future outlook.

1. Overview of Ruthenium

1.1 What is Ruthenium?

Ruthenium (Ru) is a rare, silvery-white metal with the atomic number 44. It is primarily obtained as a byproduct of nickel and platinum refining. Ruthenium is used in various applications due to its unique properties, including:

- Electronics: Used in the production of resistors and capacitors, as well as in the fabrication of hard disk drives and microelectronic components.

- Catalysis: Employed as a catalyst in various chemical reactions, including ammonia synthesis and the production of fuel cells.

- Jewelry and Decorative Items: Occasionally used in alloying with platinum and palladium to create durable and scratch-resistant materials.

1.2 Importance of Ruthenium

Ruthenium plays a vital role in several industries:

- Technology: The increasing demand for electronics and advanced technologies has led to a rise in ruthenium usage in semiconductor manufacturing and electronics.

- Energy: Its applications in catalysis and fuel cells are essential for developing sustainable energy solutions.

- Investment: Ruthenium is also considered a valuable investment metal, similar to gold and platinum.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/ruthenium-price-trends/pricerequest

2. Historical Price Trends of Ruthenium

2.1 Price Trends Over the Last Decade

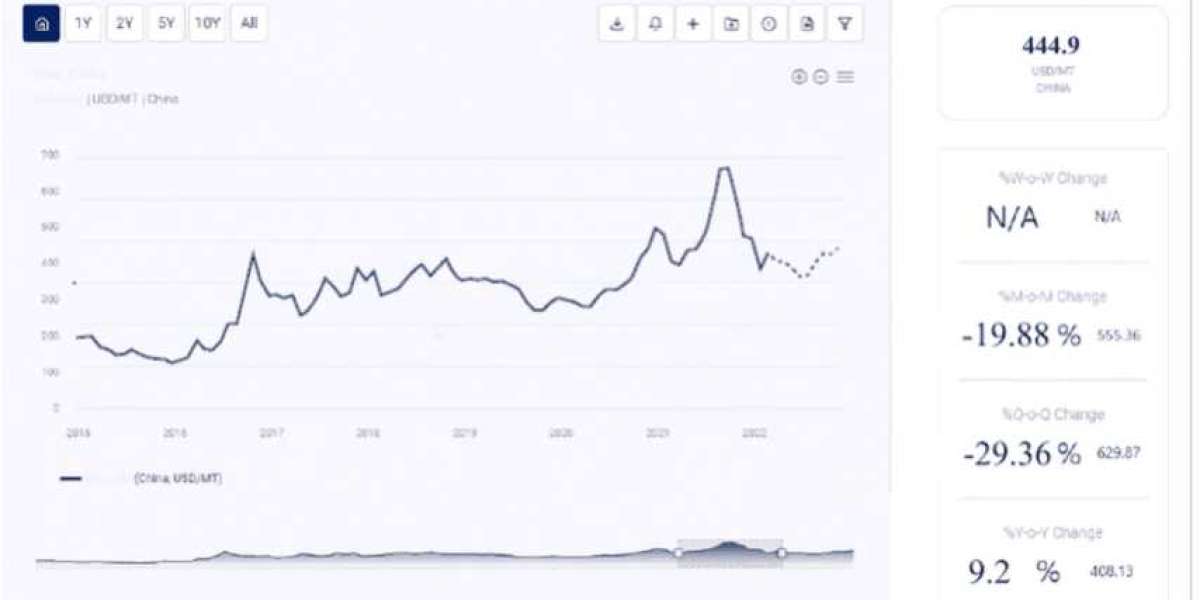

The price of ruthenium has experienced notable fluctuations over the past decade, influenced by various market factors:

- 2010-2013: Prices of ruthenium were relatively stable during this period, with modest increases attributed to steady demand from the electronics sector and limited supply.

- 2014-2015: Prices began to decline significantly due to a combination of oversupply and reduced demand. The slowdown in the electronics market, particularly in Asia, contributed to lower prices.

- 2016-2017: Prices started to recover as demand increased from the automotive and electronics industries. The growth of fuel cell technologies and their adoption in electric vehicles supported this upward trend.

- 2018-2020: Ruthenium prices saw significant volatility, reaching new highs in 2020 due to supply constraints caused by geopolitical tensions and COVID-19 pandemic disruptions.

- 2021-Present: Prices have continued to fluctuate in response to changing market conditions, with recent increases driven by renewed demand from electronics and catalysis applications.

2.2 Recent Price Movements

In recent months, ruthenium prices have shown significant variability:

- Supply Chain Disruptions: Ongoing logistical challenges and production delays have created uncertainties in the availability of ruthenium, contributing to price increases.

- Geopolitical Factors: Geopolitical tensions in key producing regions have disrupted supply chains and affected market pricing.

- Rising Demand: Increased demand for ruthenium in electronics and catalysis applications has put upward pressure on prices.

3. Factors Influencing Ruthenium Prices

3.1 Supply and Demand Dynamics

The fundamental principles of supply and demand are crucial in determining ruthenium prices:

- Production Levels: The volume of ruthenium produced annually significantly impacts pricing. Increased production can lead to lower prices, while supply constraints can result in price spikes.

- Global Demand: Demand for ruthenium is influenced by its use in electronics, catalysis, and other industrial applications, which can fluctuate based on market trends.

3.2 Economic Indicators

Several economic indicators influence ruthenium prices:

- Global Economic Growth: Economic growth in major markets often leads to increased demand for electronics and technology products, pushing prices higher.

- Inflation: Rising inflation can increase production costs, which may be passed on to consumers through higher prices.

3.3 Geopolitical Factors

Geopolitical events can have a substantial impact on ruthenium pricing:

- Market Instability: Political instability in key producing countries can disrupt supply chains and lead to price fluctuations.

- Trade Policies: Tariffs and trade restrictions can affect the flow of ruthenium and influence prices in international markets.

3.4 Market Speculation

Speculation in commodity markets can create price volatility:

- Futures Trading: Ruthenium is traded on commodity exchanges, and futures contracts can lead to speculative trading that amplifies price fluctuations.

- Investor Sentiment: Market perceptions regarding future demand and supply can drive short-term price movements.

4. Current Market Dynamics

4.1 Major Ruthenium Producers

Several countries dominate ruthenium production, influencing global prices:

- South Africa: The largest producer of ruthenium, South Africa’s production levels heavily impact global supply and pricing.

- Russia: Another significant player, Russia contributes to the global supply of ruthenium through its mining operations.

- Canada: Canada also produces ruthenium as a byproduct of platinum and nickel mining.

4.2 Consumption Trends

The demand for ruthenium is influenced by various factors:

- Electronics: The growing demand for advanced electronics, particularly in smartphones and computers, drives the need for ruthenium in microelectronic components.

- Catalysis: Increased interest in fuel cell technologies and catalysts for chemical processes supports demand for ruthenium.

- Jewelry: While a smaller portion of demand, ruthenium is still used in the jewelry industry for its unique properties.

4.3 Price Differentiation

Ruthenium prices can vary based on several factors:

- Purity and Quality: The quality of ruthenium can influence pricing, with higher purity metals commanding a premium.

- Regional Pricing Differences: Factors such as local supply and demand dynamics, production costs, and transportation expenses create price differentials across markets.

5. Future Outlook for Ruthenium Prices

5.1 Anticipated Demand Growth

The demand for ruthenium is expected to grow in the coming years:

- Green Technology Adoption: As industries shift toward sustainable practices, the demand for ruthenium in fuel cells and renewable energy applications is likely to increase.

- Advancements in Electronics: Continuous innovations in electronics and microelectronics will drive the demand for ruthenium in manufacturing.

5.2 Geopolitical Considerations

Future geopolitical events may impact ruthenium pricing:

- Political Instability: Ongoing conflicts and uncertainties in key producing countries can drive demand for ruthenium as a safe-haven asset.

- Trade Relations: Changes in international trade policies can influence supply and demand dynamics, impacting pricing.

5.3 Regulatory Changes

Future regulatory changes may affect ruthenium production and pricing:

- Environmental Compliance: Stricter environmental regulations may increase production costs, which could be reflected in higher prices.

- Sustainability Standards: Growing emphasis on sustainable sourcing and production practices may influence market dynamics and pricing.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA