Iron, one of the most abundant elements on Earth, is a critical material used in a wide range of industries, particularly in construction, automotive, and manufacturing. As the primary ingredient in steel, iron plays an essential role in global infrastructure and industrial development. Due to its importance, iron prices are closely monitored and are influenced by various factors, including demand from major economies, global supply constraints, and environmental regulations.

In this article, we will analyze historical iron price trend analysis, explore the key factors affecting its price, and discuss the future outlook for iron in the global market.

1. Understanding Iron and Its Applications

1.1 What is Iron?

Iron is a metallic element with the symbol Fe and atomic number 26. It is primarily extracted from iron ores, which are rich in iron oxides and other minerals. The most common forms of iron ore are hematite and magnetite. Iron undergoes smelting to remove impurities and produce different grades of iron, including pig iron and sponge iron, which are then processed further to make steel.

1.2 Key Applications of Iron

Iron’s primary application is in steel production, which is essential to various industries:

- Construction: Iron and steel are crucial materials in building infrastructure, such as bridges, skyscrapers, and transportation systems.

- Automotive: Steel, made from iron, is a fundamental material for manufacturing vehicles, providing strength and durability.

- Manufacturing and Machinery: Industrial machinery, appliances, and tools all rely on iron and steel components.

- Railways and Shipbuilding: Rail tracks, trains, and ships use iron and steel extensively due to their strength, durability, and resistance to wear.

As a vital component in so many industries, iron’s price fluctuations have far-reaching implications for the global economy.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/iron-price-trends/pricerequest

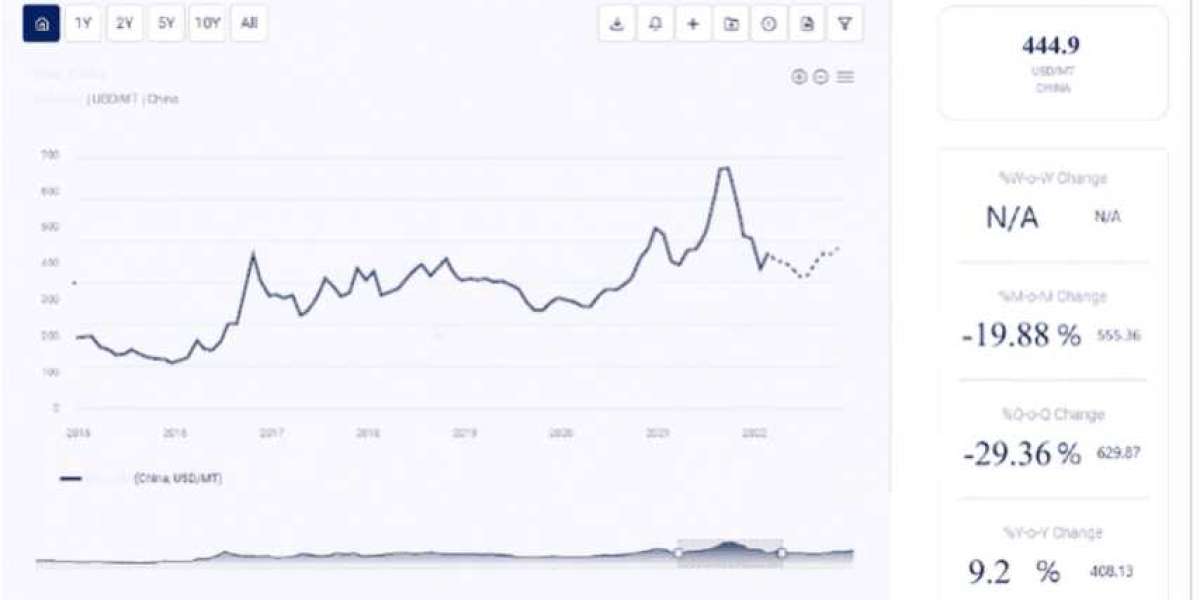

2. Historical Iron Price Trends

2.1 2000 to 2008

During the early 2000s, iron prices were relatively stable, driven by steady demand and ample supply. However, around 2004, prices began to rise significantly due to China’s rapid economic growth, which created a surge in demand for raw materials, including iron.

By 2008, iron prices reached record highs as demand from China, combined with constrained global supply, created a tightening market. Prices hit around $200 per metric ton, driven by booming infrastructure projects and industrial expansion in China. This period of growth was abruptly halted by the global financial crisis in 2008, which caused a sharp drop in demand for iron as construction and manufacturing activity slowed down worldwide.

2.2 2009 to 2015

After the 2008 financial crisis, iron prices fell sharply, bottoming out in 2009. However, prices recovered quickly due to stimulus measures in China aimed at reviving its economy. These measures included large-scale infrastructure projects, which boosted demand for steel and, consequently, iron.

From 2011 onwards, iron prices began to decline due to oversupply, as new mining projects came online to meet the earlier surge in demand. Major mining companies, such as Rio Tinto, BHP Billiton, and Vale, increased production to capitalize on high prices, leading to an oversupply in the market. By 2015, iron prices had dropped to around $40 per metric ton due to this oversupply, combined with slowing demand growth in China.

2.3 2016 to 2019

In 2016, iron prices started to recover, partly due to production cutbacks by major mining companies, which sought to balance supply with demand. Additionally, the Chinese government implemented supply-side reforms to close down outdated and inefficient steel mills, which contributed to improved steel demand for higher-quality iron ore.

Prices fluctuated between $50 and $100 per metric ton during this period, reflecting a relatively stable market driven by balanced supply and demand. The recovery was also supported by economic growth in other emerging markets, which increased global demand for infrastructure and construction materials.

2.4 2020 to Present

Since 2020, iron prices have experienced significant volatility:

- COVID-19 Pandemic: In the early months of the pandemic, prices initially fell due to reduced demand as industries shut down. However, as economies reopened, iron prices rebounded sharply, driven by strong demand for steel in China’s post-lockdown recovery.

- Supply Chain Disruptions: The pandemic also caused disruptions in mining operations and global supply chains, leading to a temporary reduction in iron supply. This tightening supply situation contributed to rising prices.

- Record Highs in 2021: In 2021, iron prices soared to over $200 per metric ton, reaching record highs as demand continued to grow. A combination of robust Chinese demand, supply constraints, and increased infrastructure spending in many countries fueled the price surge.

- Price Decline and Stabilization: After peaking in 2021, iron prices started to decline as demand in China weakened due to regulatory measures on the steel industry and a slowdown in the property sector. Additionally, increased production from major mining companies helped to stabilize prices. By mid-2022, iron prices had settled around $100 to $130 per metric ton.

3. Factors Influencing Iron Prices

3.1 Global Demand for Steel

The demand for steel, driven primarily by construction, automotive, and manufacturing sectors, is one of the most significant factors affecting iron prices:

- China’s Steel Demand: China is the world’s largest consumer of iron, accounting for around 50% of global steel production. The country’s construction and manufacturing industries heavily influence iron prices.

- Infrastructure Investments: Large-scale infrastructure projects in both developing and developed countries contribute to higher steel demand. Government stimulus measures targeting infrastructure development often lead to increased demand for steel and, consequently, iron.

Any fluctuations in steel demand, especially in China, directly impact iron prices due to the interdependent nature of these markets.

3.2 Supply Constraints and Production Costs

Iron ore supply is influenced by mining production levels and operational costs:

- Mining Production: Major mining countries, including Australia, Brazil, and India, control a significant portion of the global iron supply. Disruptions in these regions, such as labor strikes, accidents, or weather-related issues, can affect iron availability and lead to price volatility.

- Operational Costs: The cost of mining and processing iron ore is influenced by factors such as labor, fuel, and energy costs. Higher operational costs can lead to increased prices, as producers may pass on these costs to consumers.

3.3 Geopolitical Factors

Geopolitical events and trade policies play a critical role in shaping iron prices:

- Trade Tensions: Tariffs and trade restrictions between major economies, such as the U.S. and China, can impact the iron market. For example, tariffs on steel imports can reduce demand for iron in affected regions, while import restrictions may lead to increased domestic prices.

- Political Instability: Political instability in iron-producing regions can disrupt mining activities and exports, reducing global supply and driving up prices.

3.4 Environmental and Regulatory Impacts

Environmental regulations and sustainability concerns are increasingly affecting the iron and steel industries:

- Emission Regulations: As countries implement stricter emissions standards, particularly for steel production, steelmakers may be required to adopt cleaner, more costly production methods. These changes can affect iron demand and pricing.

- Carbon Reduction Targets: The global push for carbon reduction is leading to a shift toward more sustainable materials, which could reduce demand for iron in traditional industries. Conversely, demand for higher-quality, low-impurity iron ores may increase to help meet these standards.

3.5 Currency Exchange Rates

Iron is typically traded in U.S. dollars, meaning exchange rate fluctuations can impact its price:

- Stronger Dollar: A strong U.S. dollar makes iron more expensive for buyers in other currencies, which can reduce demand and lead to lower prices.

- Local Currencies: Mining companies operating in regions with weaker local currencies may benefit from lower operational costs, which can affect global supply and pricing dynamics.

4. Future Outlook for Iron Prices

The future of iron prices will depend on various factors, including demand growth in emerging economies, the global transition to sustainable materials, and advancements in steel recycling. Here are some key trends to watch:

4.1 Infrastructure Investments in Emerging Markets

As emerging economies continue to develop, infrastructure investments are expected to increase, driving higher demand for steel and iron. Countries in Africa, Southeast Asia, and Latin America are investing in transportation, housing, and energy projects, all of which require significant amounts of steel.

4.2 Sustainable Steel Production

The steel industry is under pressure to reduce carbon emissions, and this shift toward cleaner, more sustainable production methods may impact iron demand. Increased adoption of electric arc furnaces (EAFs), which can use recycled steel instead of iron ore, could reduce the need for iron in traditional steelmaking processes.

4.3 Advances in Mining Technology

Mining companies are investing in technology to improve efficiency and reduce costs. Automation, data analytics, and advanced exploration techniques can help increase production and optimize resource use. These advancements may help stabilize iron prices by ensuring a consistent supply.

4.4 Potential Supply Chain Disruptions

The COVID-19 pandemic has highlighted vulnerabilities in global supply chains, and future disruptions, whether due to pandemics, geopolitical events, or natural disasters, could affect iron prices. Diversifying supply chains and improving resilience will be essential for mitigating these risks.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA